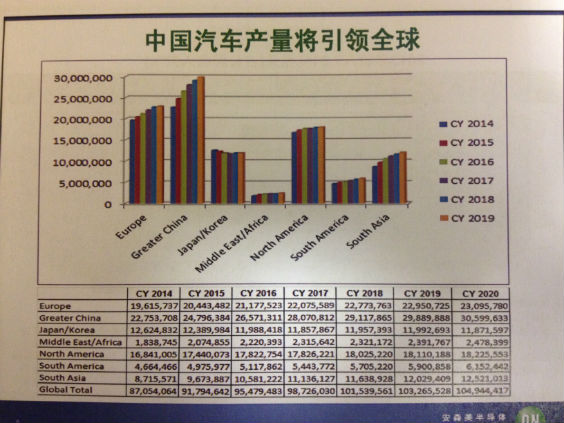

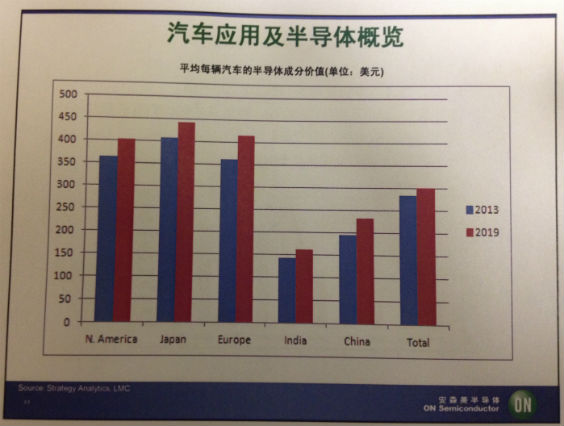

According to the latest analysis report of the market analyst Strategy AnalyTIcs, automotive semiconductors are expected to grow to $29 billion in 2014. Since 2012, the growth rate has been 11.5%. Emerging countries such as China are the countries with the largest growth rate. The growth rates in 2012 and 2014 are estimated to be 10% and 12% respectively, but the Chinese automotive industry still uses semiconductor components with relatively low value. Therefore, we can foresee that there is still a lot of room for growth in China, and the future trend is that semiconductors will largely replace mechanical devices, which will not only reduce power consumption, but also increase the value of semiconductor components.

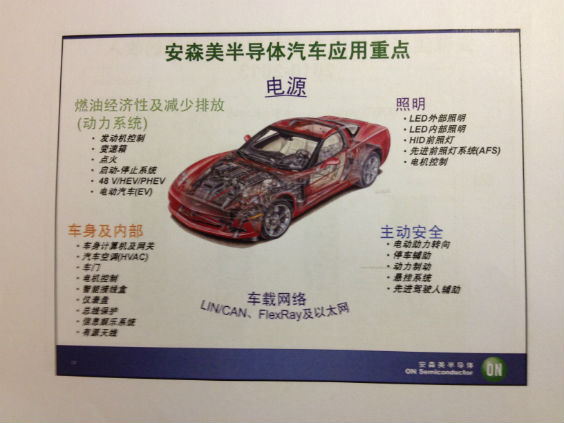

At the 2014 Shanghai Electronics Show in Munich, Xie Hongyu, Vice President of Sales for ON Semiconductor Greater China, emphasized that ON Semiconductor, a global leader in automotive semiconductor suppliers for all of China's heavyweight automakers, has a unique advanced technology platform. Through close cooperation with major customers and familiarity with the automotive market, we are currently working hard to cover major automotive electronics applications, including power systems, power supplies, in-vehicle networks, body and infotainment.

Xie Hongyu, Vice President of Sales, Greater Ansemi Semiconductor Greater China, Mr. Wu Zhimin, Director of Applied Engineering, Zuan Ansen Semiconductor

The automotive industry is growing rapidly across Asia, and its applications are everywhere. Advances in automotive design have steadily increased reliance on electronic technology, so that in a new car, European and American automakers spend an average of more than $350 on automotive semiconductors, while China currently has less than $200, and there is huge room for growth. Currently, the market's main driving force comes from the continued growth of vehicle production and the demand for electronic technology reliability, safety, performance, environmental protection and driving comfort. Automotive semiconductor suppliers must maintain their competitive edge in the market and take advantage of this huge business opportunity to launch innovative solutions that meet customer needs, while maintaining low cost, guaranteed time-to-market and high-quality product design, and achieved between the four. balance.

Judging from the layout of the depot, Korean automakers are currently second only to Japan in Asia. In the past, Korean manufacturers actively operated the low-end auto market, which was less important in quality. It was once sluggish. After strengthening quality and innovative design, it finally opened up overseas markets. In order to meet the needs of the global market, local Korean automakers must strengthen their technology to meet customer expectations, so partnerships with systems and semiconductor suppliers are becoming more important. ON Semiconductor's automotive semiconductor solutions have been successful in Europe and the United States. How to win the battle and target the fastest growing Chinese market has become the company's current top priority.

In fact, not only is ON Semiconductor, but global semiconductor manufacturers will focus on the Chinese market. Xie Hongyu, vice president of sales for ON Semiconductor Greater China, said that in recent years, the Chinese auto market has surpassed the US to become the world's largest auto consumer market. Chinese automakers are still in urgent need of satisfaction due to the huge demand of domestic consumers, so they are not eager to invest in overseas markets in the short term. Overall, the semiconductor industry in the Asia-Pacific region of the automotive electronic components market must take into account both cost and performance, in order to stand out in the fierce competition.

Wu Zhimin, director of application engineering at ON Semiconductor, pointed out that in terms of cost, ON Semiconductor attaches great importance to the use of innovation to obtain cost advantages and reduce vehicle costs through product replacement on the basis of ensuring the quality and safety of automobiles. In fact, car manufacturers must balance the cost structure. From car manufacturers to semiconductor suppliers, system design research and development must be wisely started from the first-tier supply chain, while semiconductor suppliers must invest in chip technology research and development, launch high-innovation solutions, and reduce system costs.

It cannot be ignored that building an automotive semiconductor ecosystem is also a question worth considering. Create inclusive products for sharing. The so-called inclusive product is to allow other products to participate through a certain product, and to generate profit in the process of participation.

Throughout the automotive electronics industry, there are very few inclusive products. Before the concept of car networking did not erode cars, maps should be considered the only inclusive products. In recent years, the Internet of Vehicles has brought imagination, but most of them are dominated by one-on-one dedicated models. For example, the in-vehicle system developed in the front-loading system is basically dedicated to vehicles. Many manufacturers look forward to seeing and do not come in. Relatively speaking, the products of the post-installation are more inclusive. For example, the so-called “zero-cost†car networking solution means that each brand navigation can be used without adding new modules, making it a voice-activated navigation. In addition, the voice-activated telephones released on the eve of the Kyushu Exhibition can also be connected to various navigations to realize voice-activated dialing and dialing functions. This is more inclusive than the simple implementation of voice or voice control functions in hardware.

Of course, the hardware manufacturers are limited by the hardware itself, and the inclusiveness is relatively weak. However, the inclusiveness of the future car networking products has become a factor that cannot be ignored.

Aluminum Frame LV 3PH Asynchronous Motor

Aluminum Frame Lv 3Ph Asynchronous Motor,Three-Phase Asynchronous Motor,3 Phase Asynchronous Induction Motor,Aluminum Frame Three Induction Motor

Yizheng Beide Material Co., Ltd. , https://www.beidevendor.com